In many ways, Broadcom (AVGO) has run itself like a publicly-traded private equity firm over the last few years. Hock Tan's company has used debt to buy over a half-dozen chip and hardware suppliers, and then gradually paid down the debt by cutting spending at the acquired companies and shedding unwanted assets.

From the start, Broadcom's unsolicited bid for Qualcomm (QCOM) , which has been trading at depressed multiples thanks to legal and regulatory worries, has been an ambitious attempt to double down on this strategy. Adding NXP Semiconductors (NXPI) to the equation, even at the higher purchase price that Qualcomm just agreed to, likely doesn't change Broadcom's strategic thinking much.

What the revised NXP deal does do is stretch Broadcom's buying power close to its limit. But probably not beyond it.

On Tuesday, Qualcomm announced it had revised its buyout agreement with NXP (originally struck in Oct. 2016) to feature a $127.50 per share purchase price. That represents a $17.50 per share increase from the original deal price, which NXP investors had deemed inadequate following a giant 2017 chip stock rally. Qualcomm is now committing to pay over $44 billion in cash for NXP, and assume about $3 billion in net debt.

Notably, Qualcomm's tender offer to buy NXP at the revised price, which requires 70% of NXP shares to be tendered to pass muster, expires on March 5. That's a day before Qualcomm's annual meeting, where Broadcom is aiming to take control of Qualcomm's 11-person board by offering a 6-director slate for shareholder approval. With activist Elliott Management and other major NXP shareholders backing the revised deal, there's a good chance that Qualcomm's latest tender offer succeeds.

On Wednesday, Broadcom responded to the revised NXP deal by lowering its offer price for Qualcomm by $3 per share to $79 per share. Broadcom is keeping the stock portion of its payout at $22 per share, but lowering the cash portion to $57 per share from $60. The new offer is still well above Broadcom's original bid of $70 per share.

Qualcomm shares have dropped about 3% over the last two days amid the news. Broadcom shares have risen slightly, and NXP shares have unsurprisingly jumped.

On Wednesday Qualcomm dropped 0.92%. Broadcom slipped 0.40% and NXP gained 0.04%.

At its revised offer price, Broadcom would be paying $84.2 billion in cash and issuing $32.5 billion in stock to acquire Qualcomm's equity. After factoring the NXP deal's cost and backing out the $17 billion in net cash Qualcomm had at the end of December, the deal's cash obligations rise to around $114 billion.

Even for Broadcom, that's pushing it. The chipmaker currently sports a $103 billion market cap, and had over $6 billion in net debt as of Oct. 29. In theory, this would mean that Broadcom would be saddled with around $120 billion in net debt following a deal's closing, and sport a net debt-to-equity ratio soundly above 1.

But in practice, Broadcom's debt burden would be moderately lower. Even if the company was to have its way at Qualcomm's annual meeting and ink a deal soon afterwards, it's unlikely that a deal would close before mid-2019, given the lengthy regulatory reviews it will require. And between them, Broadcom, Qualcomm and NXP are likely to produce over $20 billion in free cash flow (FCF) from the start of 2018 to mid-2019.

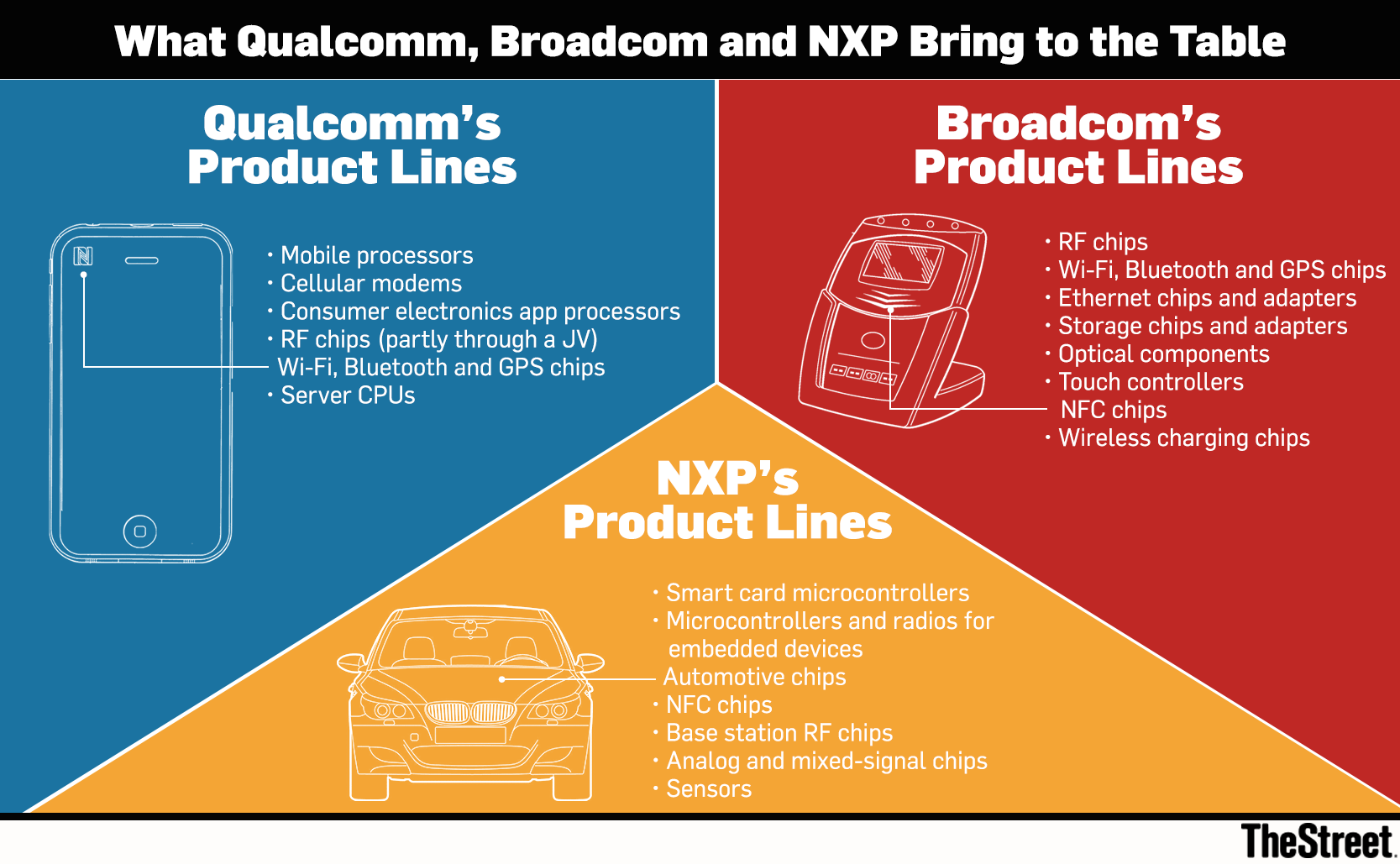

That could bring the deal's cash obligations below $95 billion, if not below $90 billion. And asset sales could lop billions more off the deal price. Given its overlap with Broadcom's Wi-Fi/Bluetooth connectivity chip business and the regulatory misgivings likely to come from it, much or all of Qualcomm's connectivity chip business is likely to go on the block. NXP's pressured smart card microcontroller business could also be sold, among other things.

And it's safe to assume that Broadcom aims to more than offset any lost cash flow from the asset sales via major cost cuts, and also by settling Qualcomm's 3G/4G patent-licensing disputes with Apple (AAPL) and a major unnamed Android licensee (reportedly Huawei). With the caveat that Broadcom has signaled it wants to "restructure" Qualcomm's licensing deals to appease phone makers, it's worth noting that Qualcomm posted $6.9 billion in FCF in fiscal 2016 (it ended in Sep. 2016, before licensing disputes began to weigh), well above the $4.1 billion analysts on average expect the company to post in fiscal 2018.

Jim Cramer and the AAP team hold positions in Apple and Broadcom for their Action Alerts PLUS Charitable Trust Portfolio. Want to be alerted before Cramer buys or sells AAPL or AVGO? Learn more now.

Throw in moderate sales growth for Broadcom, Qualcomm and NXP's core businesses thanks to various mobile, data center and automotive/IoT opportunities, and a roadmap exists for a post-acquisition company to produce close to $20 billion in annual FCF. And those cash flows, in turn, pave the way for Broadcom to start rapidly paying down the mountain of debt it will need to finance a Qualcomm deal.

Many a private equity firm would approve. Indeed, three major PE firms -- Silver Lake, KKR and CVC Capital -- have collectively agreed to provide $6 billion in convertible debt financing for Broadcom's bid. Meanwhile, 12 banks (the list includes BofA, JPMorgan, Citi and Deutsche Bank) have promised to provide up to $100 billion in credit facilities.

None of this matters of course unless Qualcomm shareholders back Broadcom's bid, and that's hardly a given. But with Broadcom's revised offer still representing a 25% premium to where Qualcomm currently trades and a 55% premium to where Qualcomm traded last fall before the first reports of a Broadcom bid arrived, shareholders have reason to consider it, even if regulatory reviews and pushback from mobile OEMs remain meaningful risks. Particularly with Broadcom offering an $8 billion reverse termination fee should regulators shoot down the deal.

Shareholder advisory firm Glass Lewis has recommended backing Broadcom's director slate; peer ISS has recommended 4 of the 6 directors, while urging Qualcomm to negotiate. Barring something unforeseen, Qualcomm's next annual meeting is shaping up to be a dramatic one.

https://www.thestreet.com/story/14496057/1/the-math-still-works-for-broadcom-s-hostile-bid-for-qualcomm.htmlBagikan Berita Ini

0 Response to "The Math Still Works for Broadcom's Hostile Bid For Qualcomm"

Post a Comment